Sell tickets for events

Connect online in 15 minutes. No integrations needed.

ثبتنام سریع

Who it is suitable for

Why choose us

- Commission of only 5% + 3.5% for acquiring

- Automatic payouts to your account

- 24/7 support and a personal manager

How it works

Register and create an event

Set up tickets and prices

Get a sales link and QR codes

Key features

Frequently asked questions

How much does it cost to connect?

Connection is completely free. A commission is charged only on sold tickets.

How quickly can I start selling?

After registration, you can create your first event and start selling in just 15 minutes.

What payment methods are supported?

Visa, Mastercard, Dina Card, Maestro, and other popular payment cards.

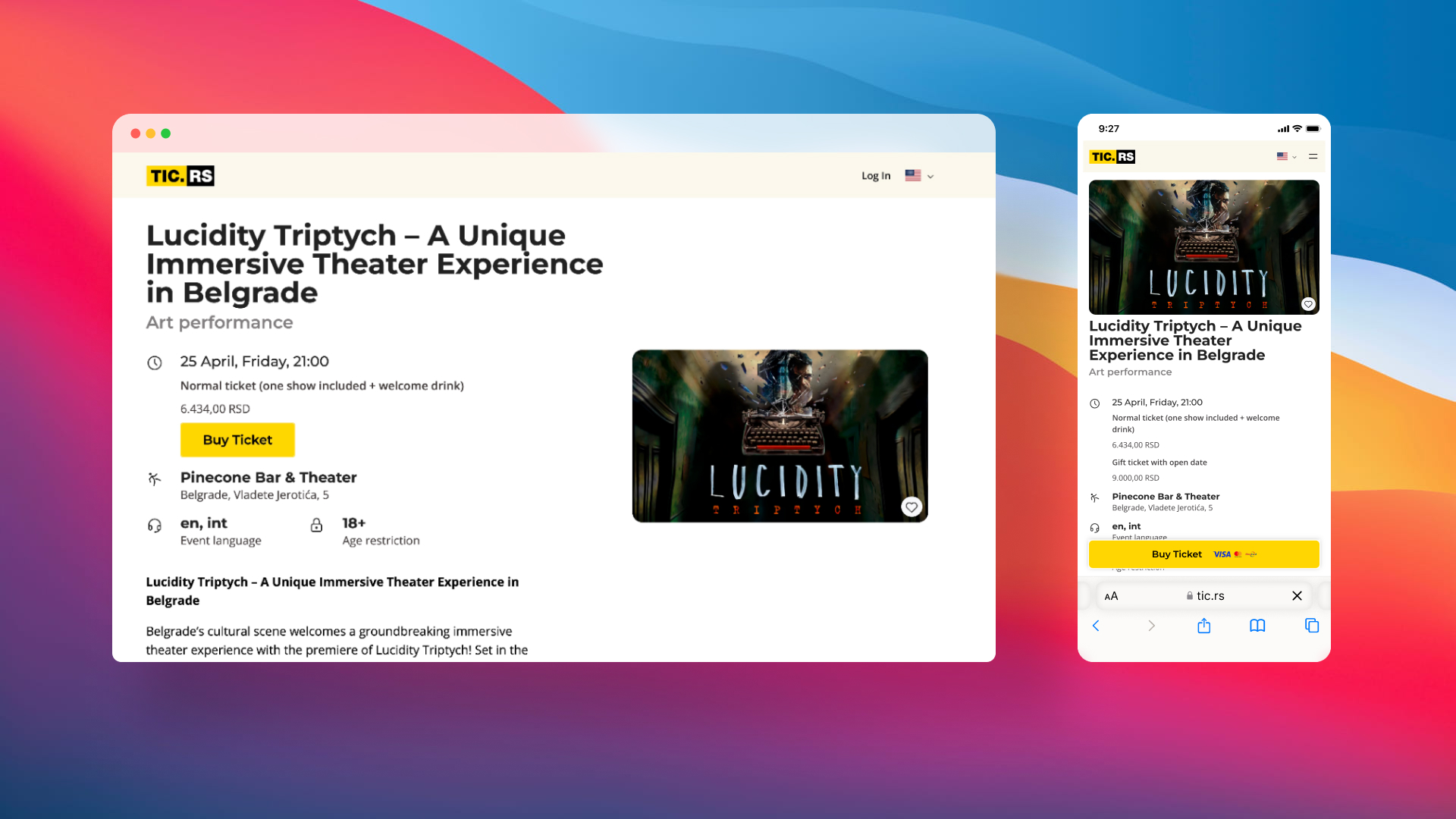

خرید بلیط

فرم به خوبی حتی با تلفن کار میکند — همه چیز سریع و واضح است.

۹۰ % کاربران از تلفن وارد میشوند — بنابراین ما بلافاصله نشان میدهیم که فرآیند پرداخت در موبایل چگونه به نظر میرسد. ساده، سریع، بدون اضافه.

همین حالا پرداخت را امتحان کنید — ۱۰۰ دینار ارسال کنید و ببینید چقدر راحت است. وجوه به توسعه سرویس میرود.

پرداخت 100 RSDصفحه رویداد

بلافاصله پس از ایجاد رویداد، شما یک صفحه فرود آماده با بلیطها، توضیحات، عکس و ویدیو دریافت میکنید. فقط لینک را به اشتراک بگذارید و بفروشید.

نقشه سالن

رویدادها را با مکانهای ثابت منتشر کنید — میتوانید سالنهای کوچک و همچنین مکانهای بزرگ با بخشها، طبقات و مناطق ایجاد کنید. مناطق، نواحی بدون تعیین مکانهای خاص هستند که میتوان بلیطها را بدون نشستن فروخت. هر منطقه یا هر مکان میتواند قیمت خاص خود را داشته باشد. نقشه سالن را برای هر فضایی تنظیم کنید و انتخاب راحتی را به تماشاگران ارائه دهید — با مکان یا بدون مکان.

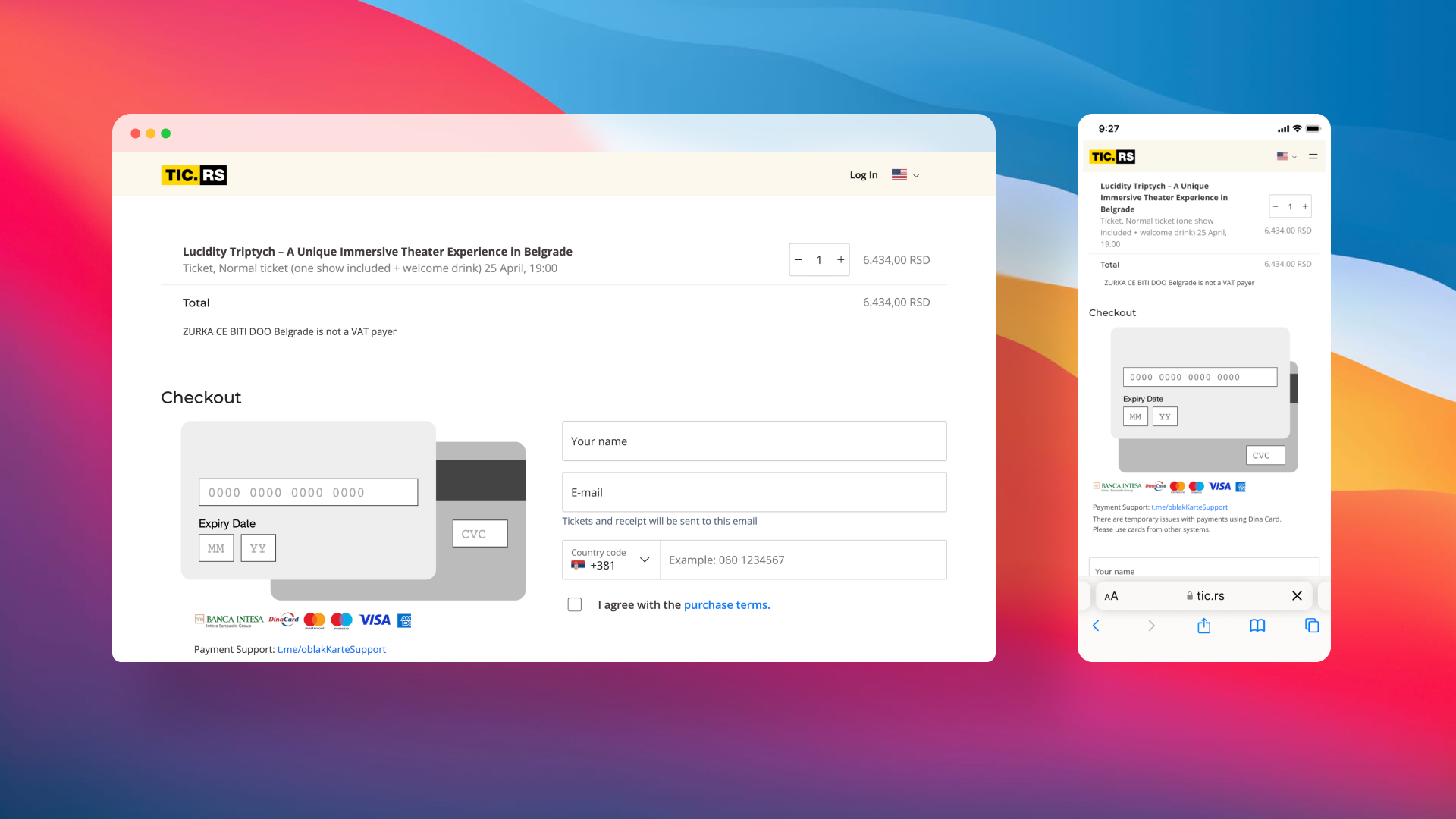

لینکهای مستقیم به پرداخت

آیا میخواهید بازدیدکننده را مستقیماً به صفحه پرداخت هدایت کنید؟ به هر نوع بلیط میتوان یک لینک مستقیم اختصاص داد. خریدار بلافاصله به فرم وارد کردن اطلاعات و پرداخت میرسد - بدون صفحات واسطه.

لینک مستقیم به پرداخت را امتحان کنید - 100 دینار پرداخت کنید و ببینید چقدر راحت است. وجوه به توسعه سرویس میرود.

پرداخت 100 RSDویجت برای وبسایت شما

دکمه «خرید بلیط» را مستقیماً به وبسایت یا لندینگ خود اضافه کنید — خریدار از صفحه خارج نمیشود و بلافاصله سفارش را ثبت میکند. این کار راحت است و نرخ تبدیل را افزایش میدهد.

- خرید بدون انتقالهای اضافی. بازدیدکننده در وبسایت شما میماند و بلافاصله بلیط را ثبت میکند — همه چیز ساده و واضح است.

- گامهای کمتر — خریدهای بیشتر. هرچه اقدامات کمتری لازم باشد، شانس اینکه فرد به پرداخت برسد بیشتر است.

- در هر وبسایتی کار میکند. میتوانید دکمه را در هر جایی قرار دهید — در لندینگ، وبلاگ، برنامه یا حتی در بلوک زمانبندی.

- زبان کاربر را درک میکند. ویجت به طور خودکار با زبان مرورگر سازگار میشود یا زبان مورد نظر را نشان میدهد، اگر آن را مشخص کنید.

مناسب برای فرمتهای مختلف رویدادها

سرویس ما چندمنظوره است - از آن برای هر نوع رویدادی استفاده کنید.

پرداختهای خودکار

پرداخت برای بلیطها، که حداکثر تا 3 روز کاری قبل از شروع رویداد انجام میشود، در روز بعد از رویداد واریز میشود. باقیمانده — برای بلیطهایی که نزدیک به تاریخ رویداد خریداری شدهاند — در روز چهارم کاری بعد از پایان آن واریز میشود.

آمار و تحلیلهای دقیق

در پنل کاربری، آمار دقیق بازدیدها، کلیکها و خریدها با تفکیک بر اساس پلتفرمها: کامپیوتر، موبایل و تبلتها در دسترس است. میتوانید برچسبهای UTM را متصل کنید تا کارایی تبلیغات را پیگیری کرده و بفهمید خریداران از کجا میآیند.

کدهای تخفیف

اگر از خود میپرسید، چگونه میتوان بیشتر بیننده جذب کرد برای رویداد خود و فروش بلیط را افزایش داد — از کدهای تخفیف استفاده کنید. این سرویس امکان ایجاد کدهای تخفیف برای تخفیف — درصدی یا ثابت را فراهم میکند. مهمانان شما میتوانند بلیطها را با تخفیف خریداری کنند، با وارد کردن کد در زمان خرید. این یکی از سادهترین و موثرترین روشها برای تبلیغ رویدادها از طریق شرکا، وبلاگنویسان و شبکههای اجتماعی است. کدهای تخفیف را پخش کنید و فروش بیشتری داشته باشید.

یادآوری SMS

بسیاری از بازدیدکنندگان زمانهای ارزشمندی را در ورود صرف میکنند، در تلاش برای پیدا کردن بلیط خود در ایمیل یا ورود به حساب کاربری. ما این مشکل را حل میکنیم: در روز رویداد هر مهمان یک SMS با یادآوری و لینک مستقیم به بلیط QR دریافت میکند. بدون نیاز به ورود، بدون جستجو — پیام را باز کرد، بلیط را نشان داد، وارد شد. این ورود را تسریع میکند و تجربه کلی مهمانان را در رویداد بهبود میبخشد.

* در حال حاضر، پیامهای SMS به مهمانانی ارسال میشود که شماره موبایل صربستانی را وارد کردهاند.

ادغام از طریق API

ما API باز را برای برگزارکنندگان رویدادها ارائه میدهیم — سفارشات را بارگذاری کنید، برچسبهای UTM را تحلیل کنید، کدهای تخفیف را اعمال کنید و به طور مؤثر کمپینهای تبلیغاتی را بهینهسازی کنید.

شما میتوانید دریافت دادههای بلیطهای فروخته شده را خودکار کنید، منابع ترافیک را پیگیری کنید و تحلیلهای خود را بسازید.

💬 آیا نظراتی در مورد بهبود API دارید؟ با ما تماس بگیرید — ما به طور فعال پلتفرم را توسعه میدهیم.

Commission calculator

Calculate the ticket price to set in order to receive the desired amount

Comparison with competitors

| Commission type | Oblakkarte.rs | Competitors | Difference |

|---|---|---|---|

| Buyers will pay | — | — | — |

| Total ticket price | — | — | — |

| Internet acquiring | — | — | — |

| Platform commission | — | — | — |

| Additional payment processing fee | — | — | — |

| You will receive (for all) | — | — | — |

Comparison result

With Oblakkarte.rs you save — when selling — tickets

Savings are calculated as the difference in ticket price for the buyerOblakkarte.rs - 8.5% including:

- • Internet acquiring: 3.5%

- • Platform commission: 5%

- Withdrawal of funds to an account in Serbia: 0%

💡 Unlike other systems, we do not add an additional service fee to the ticket price.

Competitors charge up to +4% on top, while our users only pay the ticket price.

Competitors - 12.5% including:

- • Service fee: 6%

- • Internet acquiring: 2%

- • Additional fee: 4%

- Additional payment processing fee

Attention! With competitors, the user pays an additional service fee on top of the ticket price.